Did you know…

It’s important to remember that there are a lot of factors that are beyond your control even if you are within your own apartment home. No matter what, you want to make sure your property and belongings are covered.

Our Leasing Managers agreed, the five main reasons below are why you should invest in renter’s insurance, as residents at our communities are required to obtain both renter’s and pet’s insurance.

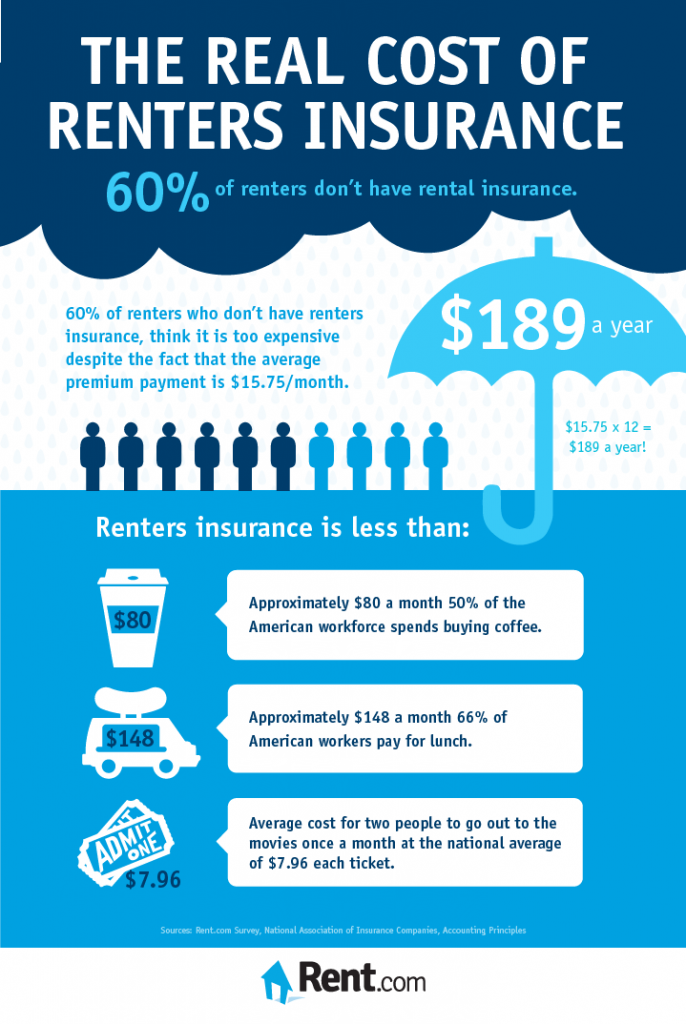

1. Affordability

Renter’s insurance provides financial protection for loss or damage of properties in your apartment home. On average, renters pay pennies on the dollar for an insurance policy that can give up to $500,000 for liability coverage and $20,000 for property damage. Why wouldn’t you have it?

2. Personal property coverage

Your policy would protect against losses to your personal property, including clothes, jewelry, luggage, electronics, and furniture. Even if you don’t own that much, it can quickly add up to a lot more than you realize, and a lot more than you’d want to pay to replace everything. For example, renter’s insurance can cover damages caused by the following:

- Fire or lightning

- Smoke

- Explosion

- Theft

- Vandalism

- Ice, snow, or sleet

- Windstorm or hail

- Water or steam from sources including household appliances, plumbing, heating, air conditioning, or fire-protection sprinkler systems

3. Liability protection

Liability coverage is also included in standard renter’s insurance policies. This provides protection if someone is injured while in your apartment home or if you (or another covered person) accidentally injure someone. It pays any court judgments as well as legal expenses, up to the policy limit.

4. Your belongings are covered when you travel

Renter’s insurance also covers your personal belongings, whether they are in your home, car, or with you while you travel. Your possessions are covered from loss due to theft and other covered losses anywhere you travel in the world.

5. Possible additional living expenses

You renter’s insurance policy may cover “additional living expenses,” including the cost associated with living somewhere else temporarily, food, and more.

We want residents at our apartment communities to be as aware as possible. While our leasing teams provide exceptional service, it’s important to get renter’s insurance in order to be extra covered. You never know what could happen. Being caught unprepared can mean huge expenses on your part. Purchasing renter’s insurance will save you from a lot of headaches and financial worries. Have questions, call our leasing offices today!